TelcoX: EMEA Leadership & Performance Report

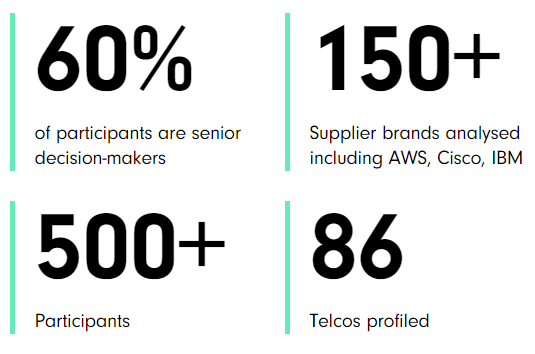

The only EMEA research study that delivers CSP investment sentiments, CSP performance rankings, and the new TelcoX Brand Leadership Bullseye.

Purchase the latest TelcoX report nowInformed by senior CSP decision-makers, giving industry-first insights.

Telco suppliers and partners. Scrutinised.

Rare insights from global telco leaders.

Watch the exclusive briefing on-demand

Get a preview and a sneak-peak at the results from the latest study in this briefing by our analysts, and understand how you can leverage this unique data to drive strategic decision-making.

Exclusive: The TelcoX Brand Leadership Bullseye

Find out which telco suppliers and partners top EMEA CSPs deem to be dominating and hitting the bullseye in telco, and who is lagging behind...

Buy the exclusive

TelcoX EMEA Leadership & Performance Report

Choose from three options:

Would you like a formal proposal or to learn more about TelcoX? Contact the TelcoTitans team discuss.

TelcoX boasts critical data and insight

for Sales & Marketing.

Data and insight that fuels strategic sales, marketing and strategy.

SALES LEADERS: leverage individual, CSP-specific data on spending priorities,

supplier/competitor positioning

MARKETING LEADERS: individual and multi-CSP priorities and vendor/partner comparison data for ABM and targeted marketing campaigns

INDUSTRY EXECUTIVES:EMEA CSP trend and supplier leadership data for strategy development

Key Topics, Telcos & Suppliers covered:

Topics

Dozens of critical topics,

thousands of datapoints

- Telco/CSP market performance/perceptions

- Telco/CSP investment priorities

- Telco/CSP direction trends

- Telco/CSP perception of themselves

- Telco/CSP threats and opportunities

- Telco/CSP supply chain priorities

- Telco/CSP vendor dependency

- Telco/CSP NPS for top 50 suppliers

- Telco/CSP thoughts on vendor openness

- Telco/CSP thoughts on vendors supporting their ESG requirements

- Telco/CSP buyer perceptions and vendor/ecosystem preferences (top 50 suppliers):

- Enterprise systems

- Automation

- Analytics

- Cloud

- Consulting and Professional Services

- Telco Hardware

- IT Systems

- Telco Networks

- Software

- Consumer Applications

- Digital Solutions

- Telco/SCP vendor perceptions (top 50 suppliers):

- Global Reach

- Forward-Looking

- Influential

- Best-in-Category

- Response

- Good Value

- Open

- Reliable

- Responsiveness

- Aligned to Needs

- Honest

- Easily Substituted

- Honest

- Delivers on Promises

Industry dynamics: view of the current market position of Telco/CSP players

Industry growth: near-future prospects for growth

Telcos

85+ leading EMEA and global CSPs

- 1&1 (United Internet)

- 4iG

- A1 Telekom Austria

- Africell

- Airtel

- Airtel Africa

- Altice (SFR)

- América Móvil (Claro/Telcel/Telmex)

- AT&T

- au

- Axiata

- Bell Canada (BCE)

- Bouygues Telecom

- BT (EE/Openreach)

- Cell C

- Charter (Spectrum)

- China Mobile

- China Telecom

- China Unicom

- Chungwa

- CK Hutchison (3/Tre)

- Colt

- Comcast (Xfinity)

- Deutsche Telekom

- Digicel

- Dish Networks/Mobile

- du

- E& (Etisalat)

- Entel

- Ethio Telecom

- Etisalat

- Frontier Communications

- HKT

- Iliad (Free)

- Jio (Reliance)

- KDDI (au/UQ)

- KPN

- KT (Korea Telecom)

- Liberty Global

- Liberty Latin America (FLOW)

- Lumen (CenturyLink)

- Millicom (Tigo)

- MTN

- MTS

- NTT (DoCoMo)

- Oi

- One New Zealand

- Ooredoo

- Optus

- Orange

- OTE (Cosmote)

- PCCW Global

- PLDT

- Proximus

- Rakuten Mobile

- RCS & RDS

- Rogers

- Safaricom

- Singtel (Optus)

- SK Telecom

- SoftBank

- Spark New Zealand

- stc (Saudi Telecom)

- Swisscom

- TalkTalk

- Telcel

- Tele2

- Telecel

- Telecom Italia (TIM)

- Telefónica (O2/Movistar/Vivo)

- Telenor

- Telia

- Telkom Indonesia

- Telkom SA

- Telstra

- Telus

- T-Mobile

- T-Mobile US

- TPG

- Verizon

- Vi (Vodafone Idea)

- Virgin Media O2

- Vodacom

- Vodafone

- Zain

Suppliers/Partners

150+ leading CSP suppliers and partners

included in the study

- Accenture

- Adobe

- ADTRAN

- Akamai (Linode)

- Alibaba (Ant)

- AlixPartners

- Allot

- Amazon (AWS)

- Amdocs

- Anritsu

- Apple

- Arista

- Atos

- Avaya

- AVG

- BAI Communications

- Bain

- Bank of America

- Barclays

- BCG

- Blackrock

- Blackstone

- BMC

- Broadcom

- Brookfield

- Calix

- Capgemini (Altran)

- Celfocus

- CGI

- Check Point Software

- Ciena

- Cisco

- Citigroup

- Citrix

- Cognizant

- Comarch

- Comba Telecom

- Comcast

- CommScope

- Corning

- Credit Suisse

- CrowdStrike

- Databricks

- Dell

- Deloitte

- Deutsche Bank

- Digital Barriers

- DigitalBridge

- Disney

- DriveNets

- Elastic

- Enghouse

- EQT

- Ericsson

- EXFO

- Extreme Networks

- EY (Parthenon)

- F5 Networks

- Fortinet

- Fujitsu

- GE Digital

- Genesys

- Global Infrastructure Partners

- Goldman Sachs

- HCL

- Hewlett-Packard

- HMD Global

- HPE

- HSBC

- Huawei

- IBM

- Infinera

- Infobip

- Infosys

- Infovista

- Infracapital (M&G)

- Intel

- Italtel

- Ivanti

- JPMorgan Chase

- Juniper

- Kearney

- Keysight

- KKR

- KPMG

- Kudelski

- Kyndryl

- Lenovo

- LG

- Macquarie

- Marsh & McLennan (Mercer/Oliver Wyman)

- Mavenir

- McAfee

- McKinsey & Co

- Meta (Facebook)

- Microsoft

- Mitel

- Morgan Stanley

- Motorola Solutions

- NetApp

- Netcracker

- Netflix

- Netgear

- NetScout

- NICE

- Nokia

- NTT

- Nutanix

- Oracle

- Palo Alto Networks

- Parallel Wireless

- Pega

- Prodapt

- PTC

- Pure Storage

- PwC (Strategy&)

- Qualcomm

- Rakuten (Symphony)

- RingCentral

- Robey Warshaw

- Salesforce

- Samsung

- SAP

- SAS

- ServiceNow

- Sitetracker

- Software AG

- Spirent

- Splunk

- Spotify

- Subex

- Talkdesk

- TCS (Tata)

- Tech Mahindra

- Technicolor

- Telit

- Teradata

- Thales

- TIBCO

- UBS

- Virtusa

- VMware

- Warner Bros. Discovery

- Wipro

- Workday

- World Wide Technology

- Xiaomi

- Zoom

- Zscaler

- ZTE

Trusted by industry leaders.

Good initiative, fosters industry thinking and benchmarking thoughts

It helps me understand how I can navigate within Vodafone

It's comprehensive, insightful, and up-to-date

Very interesting survey that will provide relevant insights to all industry

Very comprehensive and well detailed!

Buy the exclusive

TelcoX EMEA Leadership & Performance Report

Choose from three options: